This Mess is Big

Bigger Than you think, and a Fuck of a lot Bigger than Anyone will Admit to.

Welcome, my dear readers. I know I wrote poorly on economics once already and while informative, the flow left something to be desired, as I was on medication and not quite as cognizant as I might have been. I am writing again and as a Survival Saturday post because I want you to be ready. I am writing because I think we have gone past the point of no return and regardless of the reason, be it an intentional “Great Reset” where we will own nothing and be happy, as Klaus Schwab likes to talk about, if it is just the product of government incompetence, or if it is just the predictable end of another fiat currency system. Please note that no fiat currency has survived much over 100 years and the average for all fiat currencies in history is 35 years (here) globally, since forever, and the United States Dollar (USD) has been a fiat currency for 51 years this August.

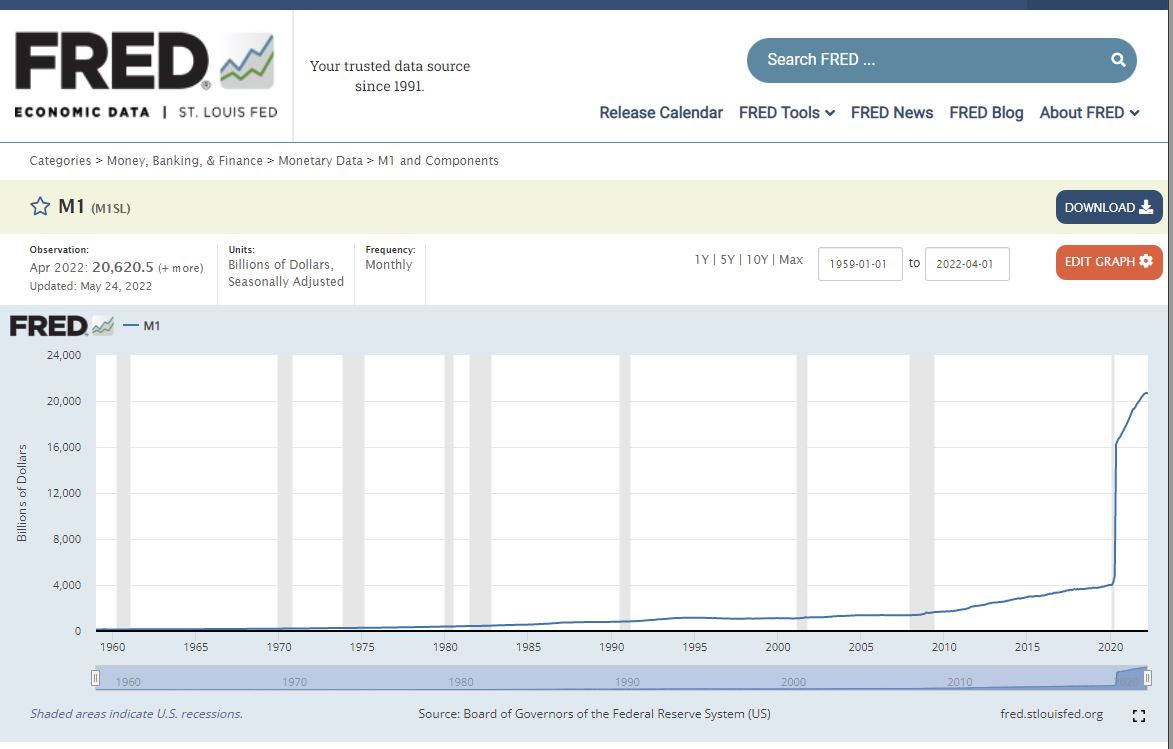

Let me first direct you to the M1 chart. This is representative of all the USD in circulation from 1959 to current. I wish it would go back further, but this is as long a view as we are allowed (here).

Please notice that the number of dollars in circulation from 1959 to 1970 were relatively stable moving from 139 Billion to 206 Billion over that period. If this chart could go back farther it would look similar, only increasing as more gold or production was added to the economy, creating actual wealth at all levels as the pie, as it were, expanded. After WWII, most of the developed world (Europe) was a smoking ruin and they didn’t have the money (gold/silver) to rebuild. As a result, the Brenton Woods agreement was made. Essentially, the United States agreed to maintain a hard currency backed by precious metals so that European governments could hold US bonds instead of gold or silver and print the money needed to rebuild their countries (here). This resulted in the USD becoming the world reserve currency. This worked fine from 1944 to the early 70s and failed because of our expenses with the Vietnam War from 1965 and the great society welfare programs of 1964 (here). These two events more than anything caused a 40 Billion increase in the M1 in 5 years and began a debt cycle that started to make other countries worried about holding US bonds, as well as the dollars backing with gold. As a result, from the late 60s into the first two quarters of 1971 many countries were cashing in US bonds to recover their value in gold (here), and since this threatened to totally deplete US gold holdings if it continued, Richard Nixon went full Vader (I am altering the deal, Pray I don’t alter it further [here]) and unilaterally closed the gold window on August 15th, 1971. In doing this he decoupled our currency totally from gold and at the same time essentially told the rest of the world if you want to cash in your bonds we have dollars for you (kind of a paper for gold bait and switch).

I realize that the history is boring, but it is relevant to the rest of the conversation. If you look from August 1971 to August 1980, as the expenses from the Great Society programs and Vietnam were allowed to unwind, the money supply doubled in less than a decade for the first time in history. This led to the stagflation of the middle to late 70s and a lot of consumer pain. That wouldn’t end until Mr. Volcker had the courage to kick interest rates from 11.9% to 21% all at once in 1981. This led to a sharp, but short recession that cleared much of the malinvestment and allowed for a strong recovery into viable projects and the 80s as a decade being remembered as one of the most prosperous ever. This history is important because from the 80s to the recession of 2007-2009, while not as stable as it had been prior to 1971, the money supply rose more or less gently and while wages lagged, it wasn’t enough to really cause pain. Then to recover starting in late 2008, not only were interest rates dropped to zero, destroying savings and enticing no-penalty malinvestment, but the money supply was vastly increased at a faster pace than any time in history until the dread COVID and in a year three dollars were created out of nothing for every dollar that existed before and over the next two years they would up it to 5 dollars for every one in existence on 1 January 2020. Unfortunately, if supply chains were perfect, and all other things were equal a 500% increase in the money supply without a corresponding increase in production of goods and efficiency (especially in less than 24 months) by itself will result in price increases across the board, many up to or exceeding 500%. Remember, real money (as opposed to fiat) is just a stand-in for the production of goods and services. So, as it expands, not only do prices fall, but everyone in the economy becomes wealthier as the available pool of wealth increases (we saw this through most of American history to the 1930s and again from the late 40s to the middle 60s).

As this unravels, expect prices to further increase on everything, especially necessities by orders of magnitude still because even without the supply chain issues, we haven’t come close to reflecting all the free COVID money in prices yet. Supply chain issues will increase the inflation and unfortunately muddy the issues as a means of political cover. I don’t even think another Volcker moment could save us, as the hike would need to be 70% or more instantly, not .5 percent here and there. Our economy is so based on profitless zombie companies (here) that to hike rates sufficiently to stave off the inflation of a 500% increase in money supply would destroy the stock market so completely that we would be seeing 1984 numbers for the Dow Jones Industrial Average. It would not only kill off 20% of all existing companies (the zombies), but an entire eco-system of profitable companies, that are only so because they feed off the zombies, would be eradicated too. Don’t expect that, because the unemployment alone from 30-40% of US firms going under would be unrecoverable.

What is going to happen is that prices are going to continue to rise and most things won’t stop until they are 200-400% higher than they are today, if they can get supply chains straightened out. If they can’t, then the sky is the limit, if things are available at all. The only exception will be real estate. It is going to crash hard. Prior to the rate hikes, the average cost of a home with a 2.5-3.5% mortgage was at or exceeding the median household incomes ability to buy (here). Now that those rates are 5% and climbing, the number of possible buyers is radically declining. Then, there are all the sub-prime borrowers propped up by government promises to pay if the loan is foreclosed. At this point, 62% of all mortgages are backed by Fannie Mae or Freddie Mac (here), 9.6% are FHA\HUD loans (here), then between USDA and VA, in total, the government is currently guaranteeing over 75% of all mortgages (here). Due to Federal equity laws masquerading as equality laws, this boom, like the last, has a lot of borrowers that wouldn’t have qualified for a loan under any other system (here). Don’t get me wrong, the unqualified will be first, but there will be a lot of qualified folks getting foreclosed before this is all over.

Unfortunately, there are only two paths out. The first would require hiking rates to destroy all the excess capital that has flooded the economy and kill off, at minimum, 20% of all publicly traded companies, destroying the illusionary wealth of many politically-connected and influential billionaires. This would be exceedingly painful but would be relatively quick, with a return to growth in a couple of years. The second path is to play like they are doing something and fiddle with interest rates small fractions at a time, while keeping an eye on the stock market, so as to preserve the illusionary wealth of non-profitable companies or companies that only are profitable due to extremely cheap credit. While this does protect the monied, it leaves the middle class in a place to fully dissolve, while all prices increase by tens or hundreds of orders of magnitude and wages are flat or increasing by 3% a year. This situation will make the stagflation of the 70s look like a boom period. In the last few years, we already lost 15-60% of small business, depending on where you live and how badly they locked down. This comes to 38.6% of all small businesses nationally (here).

What do you think? Will they save Main Street with option one? Or, Wall Street with option two? I personally don’t think any of us regular people stand a chance. This is Survival Saturday, so what do I think you should do? I don’t know how much time is left, but survival foods, buy them, be it rice and beans, cases of spam, actual product from 4patriots, patriot pantry, or any of a dozen other vendors and get as much as you can. Figure out your water supply if there is no power or the city water fails. If you don’t already have some, get arms, ammo, and training. Figure out how you will heat your home when electricity or fuel are unavailable or unaffordable. Figure out how you will cook. If at all possible, find a way out of the city and away from major highways. Learn skills to can to preserve food, fish, hunt, find wild edibles, sewing, and any other useful skills. Network. Build a team of friends and family you trust. This adds skills, hands to do the work, and resources.

I don’t know how long it will last but we are facing an existential threat like none we have ever seen. This is the death of the American fiat system and it will take most of the rest of the world with it. I don’t know if there will be revolution type fighting, I don’t know how long it will last, or how it will all eventually fall out. I do know that the central planners have painted themselves into a corner, and while I think they will try to save the elites, I don’t think there is an option where it doesn’t all burn down before it gets any better. So be ready, like legitimately ready, and if you are not there now, get going. Your dollars are worth less every day.

I hope I am wrong, but every day I am convinced more and more that I am correct. We could go down any number of rabbit holes, some more plausible than others, about how this is intentional, who is doing it, and why. Maybe we will someday more than I have already, but first you have to live through the crash and the immediate aftermath, so get ready.

Romans 13:11

Besides this you know the time, that the hour has come for you to wake from sleep. For salvation is nearer to us now than when we first believed.

God bless you.

-Sam

And to think, just a mere 2.5 years ago, one of my greatest pleasures in life was going on a yearly Carnival cruise. My how times have changed. I stepped off my last ship on January 28, 2020, and nothing has been “normal” since.