Money for Nothing...

Nothing is Free

Welcome, my dear friends and readers. This week has been a shit show. Is it the beginning of THE collapse? I don’t know, but it sure looks like it might be. This week we will examine why the system is so broken and how I believe those in positions of wealth and power intend to use it to help you ‘own nothing and be happy’.

The problem centers around the fact that the world has generated relatively little wealth in relation to the amount of money that has been generated since the 1970s. This is entirely an effect of fiat currencies used around the world and the fact that the United States Dollar (USD) has been an entirely fiat instrument since 1971. In a hard currency system, money cannot be created without first creating an equivalent or greater amount of material wealth. As an example, in monetary systems based off of gold or silver, no new currency can be produced until more gold or silver are obtained, usually through mining. These economies stay healthy because the amount of real wealth in the forms of goods and services is always increasing as the cost of those same goods and services are stable or decreasing (here).

In the theoretical healthy fiat economy (None has ever persisted in human history, going back thousands of years to Roman coins so debased as to no longer be silver in color.), money isn’t grown at a rate faster than the production of goods and services because of the restraint of central planners like the Federal Reserve (FED) or Congress. This is supposed to simulate the stability and rising living standards of a hard metal economy. This has never happened in history, however, and all fiat currencies have failed in an average on around 30 years and the fiat USD will be 52 this year.

All the fiat currencies fail because of their response to financial problems due to malinvestment, unforeseen supply shortages, or any one or combination of other calamities that befall all of us and markets from time to time. Instead of tightening to clear malinvestments, shift to alternate goods, or another solution that is required in a hard currency economy, fiat economies, not physically requiring an increase in goods or services into an economy to make more money, just attempt to fix whatever the issue is with more money. This allows for all manner of obscene and immoral happenings like fractional reserve banking, central banks, and worse. This causes inflation because fiat always increases the money supply during times of economic contraction, resulting in more money chasing fewer available goods and services, resulting in those goods and services costing more (here and here).

Imagine that a person has a bank that will cash any check they write, and he knows exactly when that check will go through. Imagine this guy decides that he makes a decent salary but really wants to live in a mansion and have a Rolls Royce with the largest, best equipped security contingent in the town. To do that he needs to make 2-3 times his current income, so he has an idea. This person writes himself a check for twice his income and obtains all the things he wants. Then Just before that check was going to bounce the guy goes to the bank and writes another check big enough to cover the first one and keep living the way he wants. While slightly oversimplified, that is essentially the way fiat currency works, if the man in the story was a nation. It is a system that, by its very nature, cannot succeed indefinitely.

The fact that fiat currencies were doomed to failure from inception was commonly accepted economic law in all serious institutions until a man named John Maynard Keynes published his book The General Theory of Employment, Interest and Money (here) that started the Keynesian School of economics. This school of economic thinking believes that government debt and inflation are irrelevant so long as the government keeps printing more money. At its heart, the fundamental premises are two horrifically flawed ideas. First, that while companies will maintain private ownership they would be guided by semi-autonomous government regulatory bodies and second, that governments at least could borrow and spend their people and nations to prosperity.

While these ideals were loved by governments everywhere, especially by the likes of Franklin Delano Roosevelt, they were countered at the time by many, including Ludwig Von Mises and into to modern day by economists of the Austrian school he founded (here an here). Looking back on history, we can see that during the Great Depression and through WWII the United States really embraced Keynesian economics as the cure-all for everything (here).

In truth, the Keynesian system is what has enabled the soft socialism that persists in all western capitalist countries and is used as the operating theory allowing for central control not only of the money supply but of interest rates and other parts of the economy. Like with any poison or cancer, the damage is in the dose and time of exposure and while the dose has been small if ever increasing compared to China, Russia, Cuba, or other socialist system, we have been injecting it for 90 years. However, the damage was always limited due to the fact the entire system was based on hard currency. There were panics (as recessions were called before the 1930s) going all the way back to the 1790s because people are fallible and mis-utilize resources. From the 1790s to the introduction of the FED, all panics were short, sharp, and mostly affected those who engaged in the malinvestment (here). After the FED, the first real panic we had was the Great Depression and it was also the first panic to receive a national general response from the government that prevented clearing of the malinvestment, prolonging the time to recovery until after the Second World War (here). Then, in 1971, all restraints were removed, outside of Paul Volker intentionally creating a recession by raising interest rates to flush malinvestment and allow for stable growth (here). It was painful, but it also ended the more harmful stagflation of the 70s and set the stage for the last American decade of prosperity from the mid-80s to mid-90s.

This came to an end with the dot com bubble, with a federal reserve response of dropping interest rates and injecting funds. This led directly to the housing bubble that popped in 2008-09, where federal anti-discrimination and fairness in lending laws joined with extremely low interest rates allowed for anyone who could fog a mirror to buy a home. This led to demand far out-stripping supply and significant increase in the cost of both rents and housing. Sadly, many of the people who purchased homes during this period were not really qualified to do so, leading to massive defaults. Once again, rather than let the malinvestment clear the market destroying much of the excess money created into a shrinking economy, the FED lowered interest rates even further and injected more money into a shrinking economy (here). There was also a temporary tightening of lending standards, most of which were later relaxed in the name of growth (read bubble).

The primary difference in these crashes to previous ones with less direct intervention is that the malinvestors weren’t the ones that got hurt. The Keynesian economic theory that had taken root in our nation allowed the losses to be passed on to the general public in the form of inflation and allowed those who misallocated resources not only to keep their gains from the misallocation but to be rewarded as the first recipients of the new monetary injections before they were devalued by inflation. All while those of use just trying to get by saw our standards of living begin to slide.

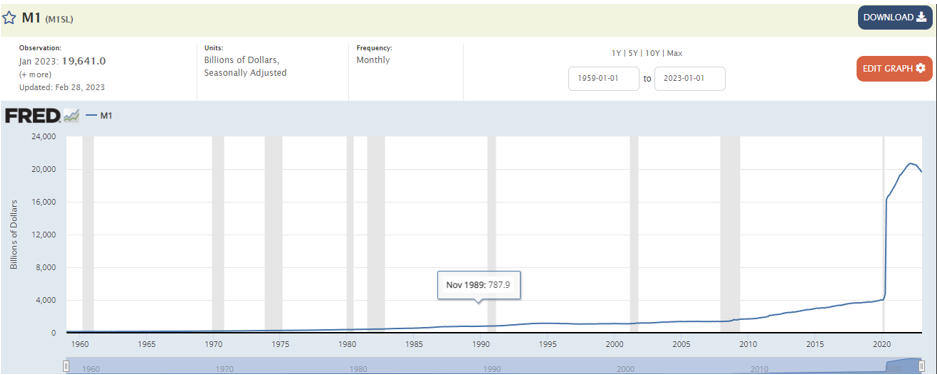

This brings us to our current disaster, one I hold started in 2020 with the forcible shutdown of most of our economy. I won’t call it a recession because the lack of production was intentional and not driven by any kind of market response to malinvestment. Since interest rates were already at essentially zero, the FED and government did the only thing they could and that is print money, and a lot of it.

Resulting in record high inflation even after everything opened back up. In an effort to fight inflation, the FED has very gently been raising interest rates and started to stop pumping money into the economy, resulting in a very slight decrease in the money supply, but not nearly enough.

Unfortunately, this very needed tightening has had other effects, both predictable and not. These effects are exacerbated by the fact that more and more the USD isn’t the primary means of clearing international trade, resulting in less of an ability to pass our inflation off overseas to reduce its impact here at home (here). The first is the impact of higher rates on Treasury Bills (TBILLS). These are short-term government securities that carry a fixed interest rate and have been seen as the safest investment. These bills are generally sold at an auction fixing their interest rate. A lot of retirement funds, banks, and other institutions use TBILLS to anchor their balance sheets since they are as close to liquid as you can get without them being cash and they carry a guaranteed rate of return.

That security of a fixed rate of return has become the problem, specifically due to artificial centrally controlled interest rates and has already claimed a couple of banks in recent days (here and here). These banks were counting on their TBILLS to be worth what they paid plus interest, but since they were purchased at a rate lower than current TBILLS are selling for, they lost value, resulting in the banks not having sufficient resources to meet demand for depositor claims. Essentially, why pay $100 for a TBILL that only earns 1% when you could buy a new TBILL for $100 that pays 6%, unless of course the other TBILL is discounted below its original cost, resulting in the holder losing money. The response naturally has been to make more fiat and use it to paper-over the problem. It won’t be long until the interest rates come down again too. At least that is what most the ‘too big to fails’ think (here and here).

The other problem is that since money was essentially free, many companies either became successful as Zombies or were happy to slip into that status (here). Rather than finding ways to delight customers and allocate resources more efficiently to create real value added to the real economy, they used cheap money to buy their own stocks, forcing the price higher, and then used the more valuable stocks as collateral for more loans (here). Thus creating artificial value without adding anything to the greater pie of goods and services that is real wealth. Once money gets expensive enough, they will be forced to sell stock between massive offerings and poor fundamentals and the value will evaporate with the zombie company overnight. We are talking around 20% or more of all companies after 13 years of nearly free money (here).

Where does that leave us? The FED has a no-win situation on its hands where it can fight inflation and continue to raise interest rates, possibly saving the USD from a Zimbabwe-like fate, or it can lower rates and turn on the cash spigots, dooming the USD and possibly preserving the illusion of prosperity, as seen in the myriad zombie companies. There is a third option that may be more horrible than any other and the FED may (probably will) try to use this to pivot to a Central Bank Digital Currency resulting in the end of all privacy in the realm of financial transactions (here). I think it is probably too late and that won’t save us either. Whatever happens, it won’t be good, and the people will lose.

I hope my history lesson and brief explanation has helped you understand what is going on a little better and that understanding helps you prepare.

Matthew 13:3-8

3 Then he told them many things in parables, saying: “A farmer went out to sow his seed. 4 As he was scattering the seed, some fell along the path, and the birds came and ate it up. 5 Some fell on rocky places, where it did not have much soil. It sprang up quickly, because the soil was shallow. 6 But when the sun came up, the plants were scorched, and they withered because they had no root. 7 Other seed fell among thorns, which grew up and choked the plants. 8 Still other seed fell on good soil, where it produced a crop—a hundred, sixty or thirty times what was sown.

God bless you,

-Sam